Price forecast from 14 to 18 April 2025

And I give you 104 percent, and I give you 84 percent, and then I give you 125 percent, and I give you 100 percent, and I give you 145 percent, and I give you 125 percent. Spring doesn’t come without a trace. We have to rest. The market maps on the sites changed color from green to red every day. Whoever came to trade for the first time got into a disco.

Hey, DJ, let’s slow it down, we’re tired of doing it! Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

Energy market:

What to say about the oil market. It’s been given a, uh. a lesson. Even before it was not as stable as it was portrayed to us under the formidable eye of OPEC+, and now it is not good at all, especially since OPEC+ seems to stop understanding what they should do: to increase or not, to reduce or not. In general, the Arabs will live even at $30 per barrel. But the rest will stand like a stumbling block.

At the moment, China does not understand where to put one third of its exports. If the situation drags on, the terracotta army may not survive the blow from Trump. On the other hand, all exporters who have so far sold goods to the US should realize that it is one thing to be paid in worthless dollars and quite another to get real money in your account. The US recovery (debt, trade balance) is good for everyone. But some won’t see it.

Interestingly, if Beijing never negotiates with Washington, we will see a rise in inflation in the US that could be much stronger than what is being presented now. Democrats are already issuing bulletins with graphics explaining to ordinary Americans that cars will now cost almost 30% more and further down the list. Bad things are coming to a head in the US that threaten a drop in demand, read, a drop in energy consumption.

Brent bounces upwards in the current situation are interesting to use for short entry.

Grain market:

The USDA report is out. We saw nothing new there. Forecasts for the 24/25 season remained at the same level, which is logical. All the focus has already shifted to what will be written in early May for the 25/26 season. And so far there should be nothing supernatural there.

The danger now is not that the seed will not be harvested, but that someone will not be able to, or will not, sell food to someone they do not like. This will lead to strong distortions, which can be eliminated by hustlers, but from merchants will require persistence and passion for profit. The industrious will be able to capitalize if a trade war escalates.

The fact is that even without imposing tariffs on each other, international trade in cereals has not been growing much in the last five years, as more and more producers appear locally. And now, in some regions of the world, there may be a situation with overstocking, although fundamentally the grain market is far from saturation.

USD/RUB:

We continue to believe that we should buy from 82.00 both on the exchange and in exchangers, somewhere at the end of April. Most likely, but not for sure, it will be the minimum level of the pair this year.

Further strengthening of the ruble could hurt the budget. At the moment we have a barrel of Urals at 50.35 dollars, down sharply from 56.00 last week, which is 4380 (if you count at 87 rubles per dollar). The budget has budgeted the cost of a barrel of oil at 6691 rubles (69.7 per barrel * 96.00 rubles per dollar)

However! We may have China on its knees, which will lead to an increase in cheap supply of goods from China on the Russian market, while the demand for imports inside Russia will also fall due to credit, which may create conditions for the pair to move below 80.00, despite the ongoing SWO.

To put it in perspective: the authorities will have to somehow solve the issue of 60 trillion in Russians’ accounts, which are deposited at almost 20%. It is necessary to create a supply of goods for such a huge money supply. At the moment, people have nothing to offer except apartments.

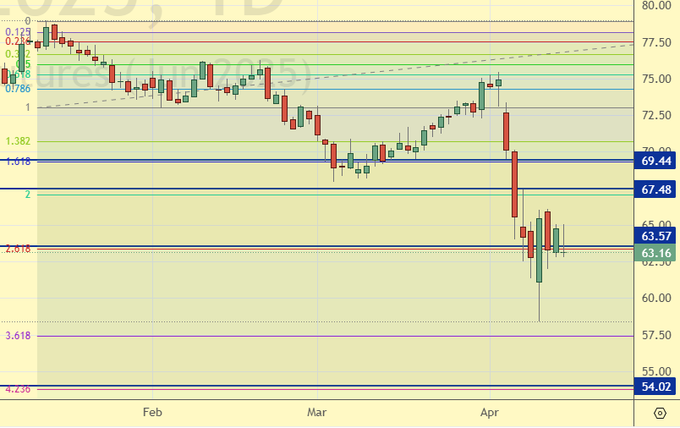

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week, the difference between long and short positions of asset managers decreased by 161.5 thousand contracts. The change is gigantic. The bulls were simply washed away from the market. Bears have all chances to take over the initiative.

Growth scenario: we consider April futures, expiration date April 30. Buy at 54.00. Not before.

Downside scenario: continue to hold shorts.

Recommendations for the Brent oil market:

Buy: when approaching 54.00. Stop: 52.00. Target: 63.00.

Sell: no. Those who are in positions from 73.00 and 71.61, move the stop to 71.70. Target: 54.00

Support — 54.02. Resistance — 63.57.

WTI. CME Group

US fundamentals: the number of active drilling rigs fell 9 units to 480.

U.S. commercial oil inventories rose by 2.553 to 442.345 million barrels, with a forecast of +2.2 million barrels. Gasoline inventories fell -1.6 to 235.977 million barrels. Distillate stocks fell by -3.544 to 111.082 million barrels. Cushing storage stocks rose by 0.681 to 25.759 million barrels.

Oil production fell by -0.122 to 13.458 million barrels per day. Oil imports fell by -0.277 to 6.189 million barrels per day. Oil exports fell by -0.637 to 3.244 million barrels per day. Thus, net oil imports rose by 0.36 to 2.945 million barrels per day. Oil refining rose by 0.7 to 86.7 percent.

Gasoline demand fell -0.07 to 8.425 million barrels per day. Gasoline production fell -0.338 to 8.946 million barrels per day. Gasoline imports rose -0.03 to 0.778 million barrels per day. Gasoline exports fell -0.059 to 0.794 million barrels per day.

Distillate demand rose by 0.327 to 4.006 million barrels. Distillate production fell -0.019 to 4.658 million barrels. Distillate imports fell -0.08 to 0.069 million barrels. Distillate exports rose -0.119 to 1.228 million barrels per day.

Demand for petroleum products fell by -0.64 to 19.481 million barrels. Petroleum products production fell by -0.848 to 20.598 million barrels. Imports of refined petroleum products rose 0.022 to 1.797 million barrels. Exports of petroleum products rose by 0.647 to 7.098 million barrels per day.

Propane demand fell -0.28 to 0.913 million barrels. Propane production fell -0.042 to 2.752 million barrels. Propane imports fell -0.01 to 0.115 million barrels. Propane exports rose 0.153 to 1.739 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers decreased by 52.9 th. contracts. Buyers fled, sellers entered the market in approximately the same volumes. Bulls may lose control in the nearest future.

Growth scenario: we consider May futures, expiration date April 22. Buying from 48.00 is interesting.

Downside scenario: it makes sense to keep short.

Recommendations for WTI crude oil:

Buy: when approaching 48.00. Stop: 46.00. Target: 58.00.

Sell: no. Those who are in positions from 70.00 and 68.28, move the stop to 70.30. Target: 48.55.

Support — 59.01. Resistance — 64.87.

Gas-Oil. ICE

Growth scenario: we consider May futures, expiration date is May 9. We will cancel the purchase from 560.00 as an idea, and buy from 420.00, if the market gives such an opportunity.

Downside scenario: we should keep shorting.

Gasoil Recommendations:

Buy: when approaching 420.0. Stop: 390.0. Target: 600.0.

Sell: no. Who is in position from 688.0 and 677.0, move the stop to 672.0. Target: 420.00 (revised).

Support — 557.75. Resistance — 641.25

Natural Gas. CME Group

Growth scenario: we consider May futures, expiration date April 28. We are waiting for lower levels for buying. We want 2,800.

Downside scenario: hold shorts. Crisis ahead and summer.

Natural Gas Recommendations:

Buy: when approaching 2.800. Stop: 2.600. Target: 3.600.

Sell: No. Those in position from 3.837, move your stop to 4.100. Target: 2.800 (revised).

Support — 3.332. Resistance — 3.735.

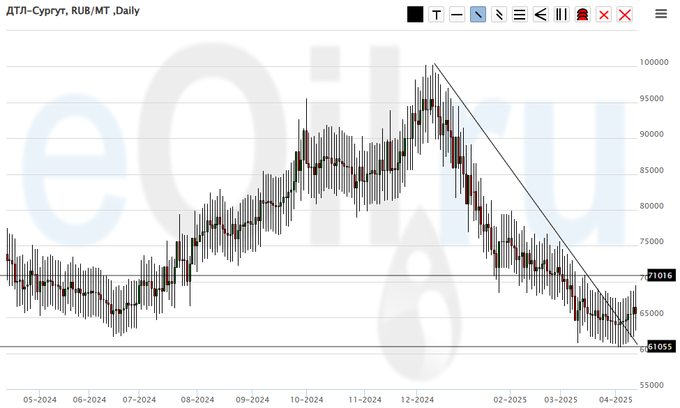

Diesel arctic fuel, ETP eOil.ru

Growth scenario: you can buy. Bad things are happening to the budget. Fuel will be taxed (hypothesis).

Downside scenario: we will not sell anything. There is a constant risk of a sudden rise in prices.

Diesel Market Recommendations:

Buy: possible. Who is in position from 64000, keep stop at 59000. Target: 120000.

Sale: no.

Support — 61055. Resistance — 71016.

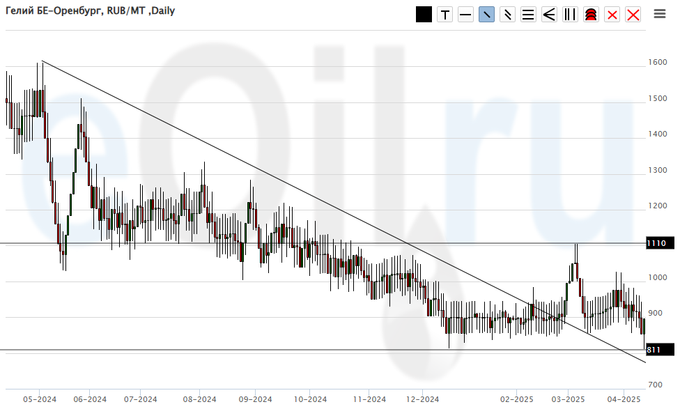

Helium (Orenburg), ETP eOil.ru

Growth scenario: knocked out of longing. Now we are waiting for growth above 1100. Sad market.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: think after rising above 1100.

Sale: no.

Support — 811. Resistance is 1110.

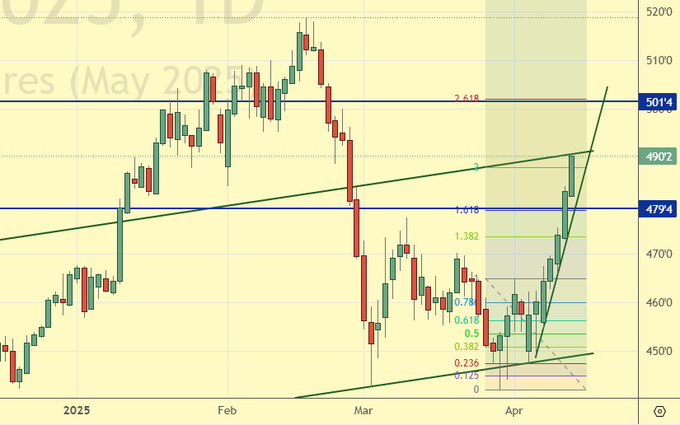

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. During the past week the difference between long and short positions of asset managers decreased by 9.9 th. contracts. Buyers were entering the market. Sellers were retreating. Bears are controlling the situation.

Growth scenario: we consider the May contract, expiration date May 14. We didn’t get 500.0! This is so… painful. Friday’s candle destroys the chances of a move down. We can try to build into a long on the pullback.

Downside scenario: so far this scenario has been canceled. Outside the market.

Recommendations for the wheat market:

Buy: when approaching 540.0. Stop: 530.0. Target: 700.0.

Sale: no.

Support — 534.0. Resistance — 574.6.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers increased by 2.8 th. contracts. Buyers and sellers arrived to the market in very modest volumes. Bulls keep control.

Growth scenario: we consider the May contract, expiration date May 14. That’s a turn. Wrong turn. Buy only on pullbacks.

Downside scenario: this is to the question of whether stop orders are necessary. Out of the market.

Recommendations for the corn market:

Buy: on a pullback to 465.0. Stop: 455.0. Target: 500.0.

Sale: no.

Support — 479.4. Resistance — 501.4.

Soybeans No. 1. CME Group

Growth scenario: we consider the May contract, expiration date May 14. Soybeans ran upward. The pullback to 1000.0 can be used for long entry.

Downside scenario: the bulls blew it all away. Out of the market.

Recommendations for the soybean market:

Buy: on a pullback to 1000.0. Stop: 980.0. Target: 1200.0?

Sale: no.

Support — 1021.6. Resistance — 1067.2.

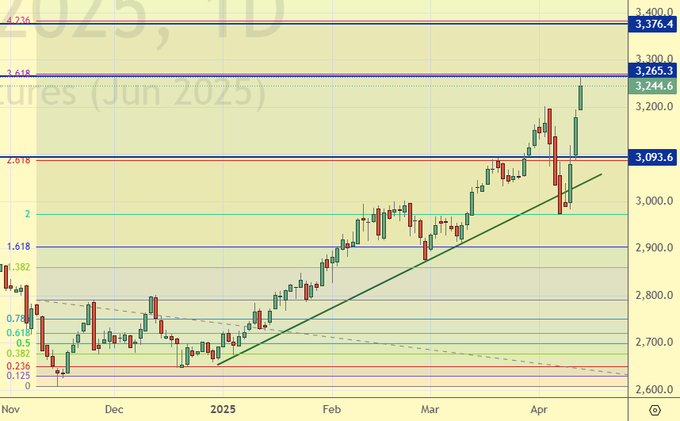

Growth scenario: we consider June futures, expiration date June 26. “With such red candles, the bulls should order a funeral service”, — we wrote a week earlier. And we were radically wrong. Out of the market.

Downside scenario: shorting from 3375 is possible. But it’s better to do it on “hours”. Outside the market. Giant volatility.

Gold Market Recommendations:

Buy: no.

Sale: no.

Support — 3093. Resistance — 3265.

EUR/USD

Growth scenario: let’s wait for a pullback to 1.1000. It is uncomfortable to buy from current levels.

Downside scenario: a short from 1.1600 can be worked out on the “hours”.

Recommendations on euro/dollar pair:

Buy: on a pullback to 1.1000. Stop: 1.0900. Target: 1.1600.

Sale: no.

Support — 1.1146. Resistance — 1.1657.

USD/RUB

Growth scenario: we consider June futures, expiration date June 19. From 82600 to buy unequivocally.

Downside scenario: a move to 82600 is the main idea for sellers. There will be an approach to 90000 you can sell.

Recommendations on dollar/ruble pair:

Buy: when approaching 82600. Stop: 81400. Target: 115000?!

Sell: on approach to 90000. Stop: 91200. Target: 82600.

Support — 86730. Resistance — 89666.

RTSI. MOEX

Growth scenario: we are looking at the June futures, expiration date is June 19. And we’re up from 90000. What about 80000? Give us 80000. It’s an outrage.

Downside scenario: high volatility. There will be an approach to 114000 — sell.

Recommendations on the RTS index:

Buy: when approaching 89500. Stop: 88300. Target: 110000.

Sell: on approach to 114000. Stop: 117000. Target: 80000 (60000).

Support — 97300. Resistance — 107970.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.