Price forecast from 9 to 13 June 2025

American politicians have begun sparring with each other in their offices. This is a step forward on the path to true democracy. Biden jumped out of the way in time; at his age, he can’t swing his fists very hard. In principle, that’s how it should be: the one who is strong and not the most savage should dominate.

For studying the social behavior of higher primates. Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

Energy market:

You know, the market is not falling. It is balanced and is not going to go down. Drilling activity in the US is falling rapidly. But on the other hand, OPEC+ will increase supply. Apparently, at a rapid pace, and apparently some countries will do so faster than others. Apparently, we are witnessing the collapse of the deal and are on the verge of an “all against all” situation. Who will win? The French lady who fills up her tiny Renault with an engine the size of two glasses of cognac.

As we noted a week ago, it may become difficult for Russia to supply larger volumes of oil to foreign markets. It is necessary to find the capacity to increase production, and these should be normally extractable reserves, not difficult-to-extract ones, which are expensive for oil companies. In addition, the goods must be delivered.

Another round of negotiations in Turkey has taken place. In the background, the parties continue to inflict significant damage on each other, which does not bring us any closer to a ceasefire. For the Russian economy, and here we are talking only about the economy, this state of affairs is acceptable for now, but the breaking point may be reached… in the foreseeable future.

Grain market:

We must note that the bearish attack on corn has stalled, and processors are happily buying it from the 435.0 region, which, along with the delayed decline in soybeans, could be a turning point in the entire history of the food market decline. Wheat also refused to be sold at 500.0 and was bought back from 506.0 last week.

Yes, the WASDE report on June 12 will clarify the situation, but even now there is a clear willingness among buyers to take the offer off the market at current prices. Given the current circumstances, including the lack of progress in negotiations on Ukraine, it can be assumed that if the forecasts for gross harvest for the 25/26 season remain unchanged, we will be unable to break through to levels lower than the current ones for all major crops. It’s a shame, I would have liked to go long deeper.

Last week, analysts noted a 5% drop in wheat harvests in China, but this news should not cause alarm. It does have an impact on prices, but the issue will be resolved in a businesslike manner, especially since last year was very good there: 140 million tons. In other words, there are reserves there.

USD/RUB:

“Overall, based on reports of a slowdown in weekly inflation, Nabiullina may make a symbolic nod to entrepreneurs by lowering the rate by 1%,” we cautiously suggested a week earlier. And that’s exactly what happened. Immediately, forecasts appeared that by the end of the year the rate would be 17%. That’s true… But for that to happen, bank customers would have to agree to a 10% rate on deposits with the same official inflation rate. And if not, then… then we’re in for a bank run and a rush to buy jewelry. You can’t buy apartments at those prices.

Brent. ICE

Let’s look at the open interest volumes for Brent. Keep in mind that this data is three days old (from Tuesday of last week) and is the most recent data published by the ICE exchange.

At present, asset managers have more open long positions than short ones. Over the past week, the difference between long and short positions of managers increased by 7.7 thousand contracts. Both sides actively entered the market. There were more bulls. Buyers remain in control.

Growth scenario: we are looking at July futures with an expiration date of June 27. We continue to stay out of the market. Purchases are only possible at small intervals during the day.

Fall scenario: there will likely be a dip to 70.80. We will use this to sell.

Recommendations for the Brent crude oil market:

Purchase: no.

Sell: when approaching 70.80. Stop: 72.80. Target: 55.00.

Support – 64.25. Resistance – 70.86.

WTI. CME Group

Fundamental data for the US: the number of active drilling rigs decreased by 9 units and now stands at 442.

Commercial oil reserves in the US fell by 4.304 million barrels to 436.059 million barrels, compared to a forecast of 2.9 million barrels. Gasoline stocks rose by 5.219 to 228.3 million barrels. Distillate stocks rose by 4.23 to 107.638 million barrels. Stocks at the Cushing storage facility rose by 0.576 to 24.086 million barrels.

Oil production increased by 0.007 to 13.408 million barrels per day. Oil imports fell by -0.005 to 6.346 million barrels per day. Oil exports fell by -0.394 to 3.907 million barrels per day. Thus, net oil imports rose by 0.389 to 2.439 million barrels per day. Oil refining rose by 3.2 to 93.4 percent.

Demand for gasoline fell by -1.189 to 8.263 million barrels per day. Gasoline production fell by -0.714 to 9.037 million barrels per day. Gasoline imports rose by 0.09 to 0.845 million barrels per day. Gasoline exports rose by 0.312 to 0.938 million barrels per day.

Demand for distillates fell by -0.742 to 3.151 million barrels. Distillate production rose by 0.182 to 4.994 million barrels. Distillate imports rose by 0.052 to 0.166 million barrels. Distillate exports rose by 0.269 to 1.405 million barrels per day.

Demand for petroleum products fell by -0.714 to 19.528 million barrels. Production of petroleum products increased by 0.188 to 22.17 million barrels. Imports of petroleum products fell by -0.07 to 1.89 million barrels. Exports of petroleum products fell by -0.691 to 6.189 million barrels per day.

Demand for propane rose by 0.302 to 0.788 million barrels. Propane production increased by 0.043 to 2.897 million barrels. Propane imports increased by 0.033 to 0.099 million barrels. Propane exports fell by -0.918 to 1.231 million barrels per day.

Let’s look at the open interest volumes for WTI. Keep in mind that this data is three days old (from Tuesday of last week) and is the most recent data published by the CME Group exchange.

At present, asset managers have more open long positions than short ones. Over the past week, the difference between long and short positions of managers increased by 40.7 thousand contracts. Bulls entered the market, while sellers fled. Bulls remain in control.

Growth scenario: we are considering July futures with an expiration date of June 20. Purchases are only possible at small intervals during the day. Outside the market.

Fall scenario: knocked out of the short position. Currently out of the market. When approaching 68.00, we go short.

Recommendations for WTI crude oil:

Purchase: no.

Sell: when approaching 68.00. Stop: 70.00. Target: 53.00.

Support – 64.16. Resistance – 68.74.

Gas-Oil. ICE

Growth scenario: switched to July futures, expiration date July 9. No place to buy. Outside the market.

Fall scenario: approaching 660.0 will present a good opportunity for shorting.

Recommendations for Gasoil:

Purchase: no.

Sell: when approaching 660.0. Stop: 680.0. Target: 500.0.

Support – 586.75. Resistance – 628.75.

Natural Gas. CME Group

Growth scenario: switched to July futures, expiration date June 25. You can buy. Friday’s green candle is interesting.

Fall scenario: we are not selling.

Recommendations for natural gas:

Purchase: now (3.784). Stop: 3.430. Target: 7.000?!

Sale: no.

Support – 3.432. Resistance – 3.847.

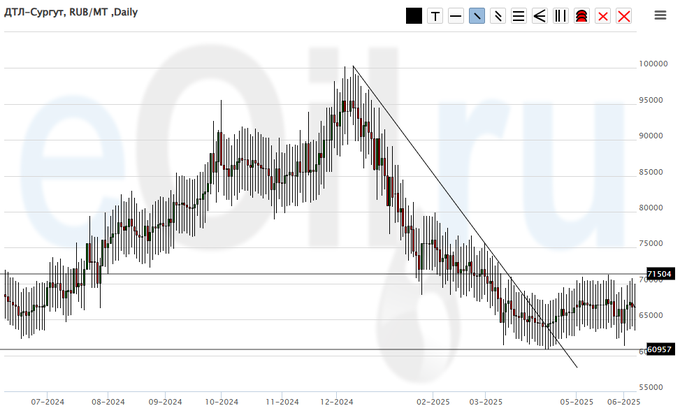

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we continue to recommend buying. Bad things are happening with the budget. Fuel will be taxed (hypothesis).

Fall scenario: we will not sell anything. There is a constant risk of sudden price increases.

Recommendations for the diesel market:

Purchase: possible. If you are in a position from 64,000, keep your stop at 59,000. Target: 120,000.

Sale: no.

Support – 60,957. Resistance – 71,504.

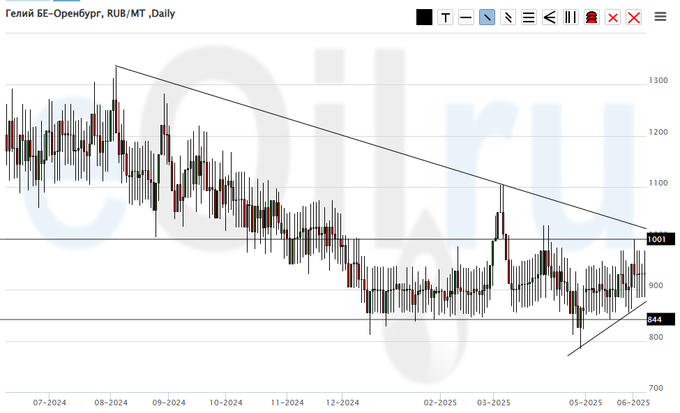

Helium (Orenburg), ETP eOil.ru

Growth scenario: we expect growth above 1100. A sad market. It is possible that prices will begin to take inflation into account in the future.

Fall scenario: we remain outside the market, prices are low.

Recommendations for the helium market:

Purchase: consider after growth above 1100.

Sale: no.

Support – 844. Resistance – 1001.

Wheat No. 2 Soft Red. CME Group

Let’s look at the open interest volumes for Wheat. Keep in mind that this data is three days old (from Tuesday of last week) and is the most recent data published by the CME Group exchange.

At present, asset managers have more open short positions than long ones. Over the past week, the difference between long and short positions held by managers has increased by 0.7 thousand contracts. We are seeing a slight outflow of funds from the market. Bears remain in control.

Growth scenario: we are considering the July contract, expiry date July 14. We are stuck at a point where it is difficult to give specific recommendations. Out of the market.

Fall scenario: out of the market. Waiting for data from the USDA.

Recommendations for the wheat market:

Purchase: no.

Sale: no.

Support – 526.4. Resistance – 554.6.

Corn No. 2 Yellow. CME Group

Let’s look at the open interest volumes for corn. Keep in mind that this data is three days old (from Tuesday of last week) and is the most recent data published by the CME Group.

At the moment, asset managers have more open short positions than long ones. The bears have taken control! Over the past week, the difference between long and short positions of managers has increased by 43,800 contracts. This is a significant change. There were no bulls. Short bets rose sharply. The bears have tightened their grip!

Growth scenario: switched to the July contract, expiry date July 14. For now, we need to be patient and wait. We will definitely buy, but not now.

Fall scenario: keep short positions. And wait. I want 300.0!!!

Recommendations for the corn market:

Purchase: no.

Sell: no. If you are in a position at 459.0, move your stop to 452.0. Target: 300.0?!!!

Support – 433.2. Resistance – 446.0.

Soybeans No. 1. CME Group

Growth scenario: we are considering the July contract, expiry date July 14. This is all very suspicious, but we will only buy after growth above 1111.0.

Fall scenario: we will continue to hold short positions. Soybeans should decline. However, this decline has not yet occurred. We are waiting.

Recommendations for the soybean market:

Purchase: if it goes above 1111.0. Stop: 1040.0. Target: 1300?

Sell: no. Those in position at 1060.2, keep your stop at 1080.0. Target: 840.0?!

Support – 1031.4. Resistance – 1073.0.

Growth scenario: considering June futures, expiration date June 26. The situation remains balanced. Outside the market. If we go to 2800, we will consider buying.

Fall scenario: an unfavorable close to the week. Go short only after a drop below 3250. We will write a direct recommendation, but such a trade can be skipped.

Gold market recommendations:

Purchase: no.

Sell: if it falls below 3250. Stop: 3350. Target: 2800. Consider the risks!!!

Support – 3256. Resistance – 3412.

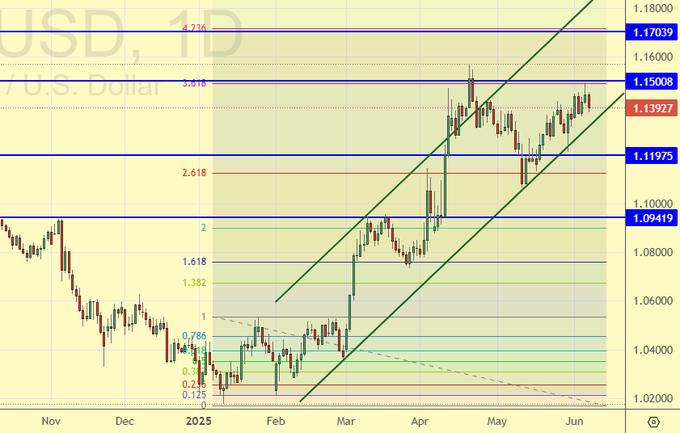

EUR/USD

Growth scenario: uncertain growth amid ECB rate cuts. Out of the market.

Fall scenario: forced to work through this pattern. We will sell.

Recommendations for the euro/dollar pair:

Purchase: no.

Sell: now (1.1392), then when approaching 1.1500. Stop: 1.1530. Target: 1.0580.

Support – 1.1197. Resistance – 1.1500.

USD/RUB

Growth scenario: we are looking at June futures, expiry date June 19. Nothing new. A reversal is needed to enter a long position.

Fall scenario: selling is uncomfortable. Looking for opportunities in other markets.

Recommendations for the dollar/ruble pair:

Purchase: in case of growth above 81,500. Stop: 79,500. Target: 115,000. Consider the risks.

Sale: no.

Support – 78587. Resistance – 80981.

RTSI. MOEX

Growth scenario: considering June futures, expiration date June 19. Wild volatility amid the Central Bank of Russia’s decision on interest rates. Out of the market.

Fall scenario: we cannot go above 116,000. As long as this is the case, selling makes sense.

Recommendations for the RTS Index:

Purchase: no.

Sell: when approaching 115,000. Stop: 116,700. Target: 60,000?

Support – 108,370. Resistance – 115,780.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.