Price forecast from 5 to 9 May 2025

I’ll tell you what’s going on here. Look. You’re a bomber at the train station. Once a day a train comes to the platform, 50 people get off, and you take one or two and you dust off to the village. One or two more, your buddy takes one or two more. And Loser, that’s the third, he may not get any. He only gets a client a day later. And you’re all just fine. No more clients. The rest of you beggars go to the village to rub your soles. So why are you increasing oil production by 400 thousand barrels in May, and then you are going to raise it by the same amount in June, even more — 411 thousand bpd. Are you taking revenge on Kazakhstan and the second Kazakhstan for the fact that they produce more than the quota? Are you out of your mind? Nobody does that. Nobody, I’m telling you. Not even the bombers do it. Only 50 people get off the train and 45 of them are beggars.

To the mind that has left us… without cheers. Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

Energy market:

In general, the Arabs have condemned the oil market, and not only them, of course. All this will now go somewhere by 40.00, there will be debates in the collective farm, then it will be 35.00, someone will die of a heart attack right at the meeting, because it is better not to return to your country, or they will eat you on arrival. They’ll come to their senses. They’ll start thinking. See if all the American shale oil companies are dead. And if there are any survivors, we will make 25, 15, and minus 30 dollars per barrel. We’ve seen such things. Having mowed down the first rows, the schizo has taken up the second rows. That’s all the fundamental analysis for today.

Yes, we recommended selling, but it was still a recommendation from the series: maybe, possibly, probably. Well, all right, short, so short.

The most interesting thing is in the US. If Trump eats Powell, at the beginning all goods will rise, on expectations of low interest rates and economic growth, but then inflation, the rate of 20% already in the U.S., and then everything will collapse. Who wants that?

On the down-to-earth side, the internal combustion engine is coming back. There’s a lot of hassle with batteries. You need infrastructure, it’s all expensive, unsafe, unprofitable. The reincarnation of the internal combustion engine, buried by the prophets of the future, may lead to stabilization of the oil market, even if there is a recession in the US, which, if leading indicators are to be believed, will be prolonged.

Grain market:

It is difficult for the bulls to come up with news from which the market could push back and fly upwards. Expectations of a new harvest remain strong, which is reflected in prices. There are no buyers even in a situation when tomorrow or the day after tomorrow the conflict between India and Pakistan is going to flare up. People are emotionally burned out after the pandemic, the second coming of Trump and the rest. They need not just stress, but a direct statement from the UN Secretary General: “Tomorrow there will be nothing to eat!” And since no one is saying such a thing, there is no point in buying.

In fact, there is such a sense, but you will have to be patient. According to experts’ forecasts, moderate prices are expected on the grain market during the next two-three seasons. Therefore, it is possible (long-term!) to look for longing opportunities without a big leverage.

It should be recognized that “success” in the agricultural sector of Russia may bring an unpleasant surprise at the end of this season, there is a risk of not getting 80 million tons of wheat. Preferential lending is unlikely to go to everyone. Many farmers will find the interest on the loan unaffordable and will stop working on the land. This is a reason to continue enlargement of agricultural holdings that have access to free money.

USD/RUB:

The interest rate is 21%, and the budget deficit is not 1.3, but 3.7 trillion rubles. And it’s only the end of April.

And where to get them? Banks can lend to the state, it is true, but they have to get something as collateral, no one will buy OFZs from a certain point, and this collateral will have to be sold at auction at least at some price inside the country, because there will be no buyers from outside.

If the current trend continues, the banking system will not be able to pay interest on deposits sooner or later. Because now most of the economy is not engaged in the generation of added value, but shakes the air with TNT. If spending on the military-industrial complex does not decrease by the end of this year, we will see 120 rubles per dollar at a rate of 21%. If the rate growth continues, then for some time investors will play a game of “who is faster” with banks: either I will jump out or you will collapse. No insurance agencies will give away any deposits. There’s not that much there. But that’s not tomorrow, not tomorrow. Eh… we would like to get through August, as always.

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers decreased by 6.1 thousand contracts. We saw outflows of sellers and buyers in minimal volumes. Bulls maintain control.

Growth scenario: we consider June futures, expiration date May 29. We don’t want to go up. Out of the market.

Downside scenario: continue to hold shorts.

Recommendations for the Brent oil market:

Buy: no.

Sell: no. Those who are in position from 72.51 and 71.10, move the stop to 67.60. Target: 54.70 (40.20?)

Support — 58.03. Resistance — 64.39.

WTI. CME Group

US fundamental data: the number of active rigs decreased by 4 units to 479.

U.S. commercial oil inventories fell by -2.696 to 440.408 million barrels, with a forecast of +0.39 million barrels. Gasoline inventories fell by -4.003 to 225.54 million barrels. Distillate stocks rose 0.937 to 107.815 million barrels. Cushing storage stocks rose by 0.682 to 25.701 million barrels.

Oil production increased by 0.005 to 13.465 million barrels per day. Oil imports fell by -0.091 to 5.498 million barrels per day. Oil exports rose by 0.572 to 4.121 million barrels per day. Thus, net oil imports fell by -0.663 to 1.377 million barrels per day. Oil refining rose by 0.5 to 88.6 percent.

Gasoline demand fell -0.316 to 9.098 million barrels per day. Gasoline production fell -0.616 to 9.457 million barrels per day. Gasoline imports fell -0.277 to 0.581 million barrels per day. Gasoline exports rose 0.03 to 0.705 million barrels per day.

Distillate demand fell -0.353 to 3.55 million barrels. Distillate production fell by -0.017 to 4.609 million barrels. Distillate imports rose 0.002 to 0.099 million barrels. Distillate exports fell -0.132 to 1.024 million barrels per day.

Demand for petroleum products fell by -1.721 to 19.154 million barrels. Petroleum products production fell by -1.304 to 20.82706 million barrels. Petroleum product imports fell -0.689 to 1.497 million barrels. Exports of refined products rose by 0.089 to 6.524 million barrels per day.

Propane demand increased by 0.43 to 0.878 million barrels. Propane production rose 0.017 to 2.852 million barrels. Propane imports fell -0.007 to 0.09 million barrels. Propane exports fell -0.179 to 1.982 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers increased by 8.3 th. contracts. Buyers came to the market. Sellers in about the same volumes. For Tuesday of last week bulls kept control.

Growth scenario: we consider June futures, expiration date May 20. Buying is not interesting yet. Out of the market.

Downside scenario: we will continue to hold the short.

Recommendations for WTI crude oil:

Buy: no.

Sell: no. Who is in position from 69.72 and 68.00, move the stop to 64.30. Target: 49.48 (revised).

Support — 49.48. Resistance — 64.33.

Gas-Oil. ICE

Growth scenario: we consider June futures, expiration date June 11. There is nowhere to buy. Out of the market.

Downside scenario: we will continue to hold the short. Growth above 700.0 is needed to change sentiment to bullish.

Gasoil Recommendations:

Buy: when approaching 420.0. Stop: 390.0. Target: 600.0.

Sell: no. Who is in position from 688.0 and 677.0, move the stop to 626.0. Target: 420.00.

Support — 558.50. Resistance — 607.00

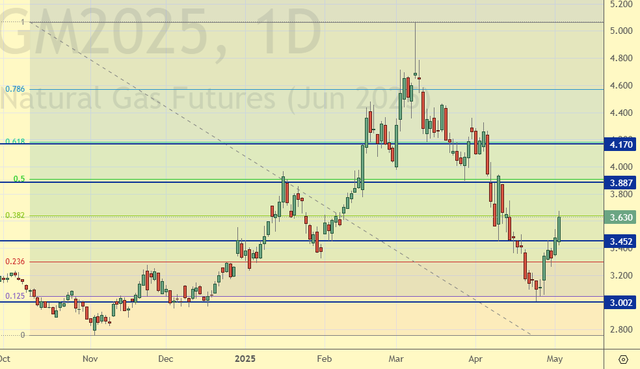

Natural Gas. CME Group

Growth scenario: we switched to the June futures, expiration date May 28. Purchases were justified. We hold long.

Downside scenario: we are not selling yet. Let Europe put gas in storage.

Natural Gas Recommendations:

Buy: No. Who is in position from 3.114, move stop to 3.114. Target: 6.000?!!!!!

Sale: no.

Support — 3.452. Resistance — 3.887.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. Over the past week the difference between long and short positions of asset managers increased by 30.4 th. contracts. Massive attack of sellers. Bears strengthened their control.

Growth scenario: moved to July contract, expiration date July 14. We need confirmation to buy. Let it rise above 561.0.

Downside scenario: no interest in selling.

Recommendations for the wheat market:

Buy: after growth above 561.0. Stop: 549.0. Target: 700.0.

Sale: no.

Support — 523.0. Resistance — 550.6.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers decreased by 46.3 th. contracts. Sellers were coming to the market, buyers were closing positions. Bulls may lose control.

Growth scenario: switched to July contract, expiration date July 14. Buy only on pullbacks.

Downside scenario: you can keep shorts, but don’t give much space to the market.

Recommendations for the corn market:

Buy: on a pullback to 462.0. Stop: 452.0. Target: 500.0.

Sell: no. Who is in the position from 492.2 (taking into account the transition to a new contract), move the stop to 486.2. Target: 380.0?!!!!!

Support — 462.2. Resistance — 477.2.

Soybeans No. 1. CME Group

Growth scenario: we consider the July contract, expiration date July 14. The pullback to 1000.0 can be used for long entry.

Downside scenario: it is possible to keep shorting. It cannot be ruled out that all agricultural commodities will lose value as we approach the release of the May USDA report.

Recommendations for the soybean market:

Buy: on a pullback to 1000.0. Stop: 990.0. Target: 1200.0?

Sell: no. Who is in position from 1059.2, keep stop at 1072.0. Target: 880.0

Support — 1036.6. Resistance — 1081.4.

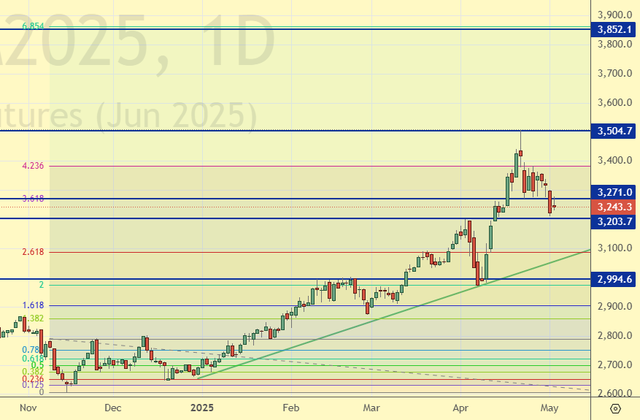

Growth scenario: we consider June futures, expiration date is June 26. We refrain from buying until the market resumes growth. We note the high volatility.

Downside scenario: we can hope for prices to come down somewhat. But for now below 3000 the market is not visible.

Gold Market Recommendations:

Buy: no.

Sell: No. Who is in position from 3249, keep stop at 3353. Target: 3000.

Support — 3203. Resistance — 3271.

EUR/USD

Growth scenario: the pair has built back down. And that’s not good for the bulls. Don’t buy.

Downside scenario: we never got to 1.1650. We can sell from the current marks, but it is not a very good deal, let’s say it directly.

Recommendations on euro/dollar pair:

Buy: no.

Sell: now (1.1298). Stop: 1.1450. Target: 1.0000?! Count the risks.

Support — 1.1146. Resistance — 1.1307.

USD/RUB

Growth scenario: we consider June futures, expiration date June 19. During the week the changes are minimal. We are still in a falling channel, but there is a risk of an upward reversal.

Downside scenario: uncomfortable to sell. Looking for opportunities in other markets.

Recommendations on dollar/ruble pair:

Buy: when approaching 82250. Stop: 81400. Target: 115000?! In case of growth above 88200. Stop: 85000. Target: 115000. Consider the risks.

Sale: no.

Support — 83679. Resistance — 86840.

RTSI. MOEX

Growth scenario: we consider June futures, expiration date June 19. We continue to refuse to buy. Let’s go to 60000 and buy everything there!

Downside scenario: we should keep shorting. In fact, we can count on very deep marks.

Recommendations on the RTS index:

Buy: no.

Sell: no. Who is in the position from 115300 and 114500, move the stop to 115200. Target: 80000 (60000).

Support — 101120. Resistance — 109020.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.