Price forecast from 30 June to 4 July 2025

The missiles quickly ran out. A semblance of peace was declared, which could be broken at any moment. The factories of both countries are probably busy replenishing their arsenals around the clock. It is possible that the US has opened its reserves and the current truce is needed to deliver weapons to Israel. And then? And then everything starts all over again. Until American democracy is established on the entire planet.

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

Energy market:

The oil market was shaken up and down. Fast war, fast peace. Everything is very fast. The swords quickly became dull and now some will have to patch up the «iron dome» and others will have to bury centrifuges for enriching uranium even deeper in the ground. A kilometer. And why not.

Some speculators have clearly suffered losses, since it is almost impossible to survive 10% movements with 10% leverage. Most likely, traders will behave carefully for another week, since on July 6, OPEC+ should tell us how it sees the future of the oil market, how much more will be poured into it. At the same time, a signal came from Russia that Moscow will not interfere with the Arabs «killing» American oil producers by dumping. Not the best time for Russia, but at least there is solidarity. A smooth and controlled decline in prices is better than their collapse.

Iran has not suffered much from the Israeli aggression in terms of its ability to continue exporting oil. It is possible that the Persians were expecting an attack, since data shows that Iran increased oil exports to China to 1.5 million barrels per day in June, almost 1.5 times more than in May. It may be a coincidence… or it may not.

Grain market:

We do not know for sure whether Iran and Israel have finished their bloody dirty tricks or not, but even the suspension of the exchange of blows led to the wheat market going down following corn. Things are generally good with the new harvest. IGC raised its wheat forecast to the USDA level of a month ago, from 806 to 808 million tons. It is worth noting the more positive forecasts for Russia; if in the spring there were doubts about the ability to harvest 80 million tons of wheat, now there are no such doubts. We will discuss the quality of grain later.

With the current low prices, which in Europe are gravitating towards $240 per ton, and we may see $230 in the near future on FOB Novorossiysk, there is no point in talking about great optimism among farmers and grain traders. They will have to fight with the same Europeans for sales markets in Africa and the Middle East. Political preferences are easily pushed into the background when you are offered a lower price for real transactions.

USD/RUB:

The rouble looks hypertrophied strong against the backdrop of falling oil revenues and ongoing spending on the oil and gas sector.

It is possible that demand for rubles is provided through an indirect inflow of funds from foreign investors interested in buying Russian government securities that provide good returns; this is a theory that has not been confirmed. But it is not surprising that it is not. Money loves silence.

In the current technical picture, we can expect September futures to try to go below 80,000.

Brent. ICE

Let’s look at the volumes of open interest for Brent. You should take into account that this data is three days old (for Tuesday of last week), and it is also the most recent of those published by the ICE exchange.

There are currently more open long positions among asset managers than short ones. Over the past week, the difference between long and short positions of managers has narrowed by 26.2 thousand contracts. The number of sellers has increased sharply. Buyers retain control.

Growth scenario: we are considering the August futures, expiration date is July 31. When approaching 64.00, you can buy.

Downside scenario: Sellers may return to the market if we rise to 74.00.

Recommendations for the Brent crude oil market:

Buy: when approaching 64.00. Stop: 62.00. Target: 74.00.

Sell: when approaching 74.00. Stop: 76.00. Target: 64.00.

Support – 65.95. Resistance – 69.47.

WTI. CME Group

US fundamentals: the number of active drilling rigs fell by 6 units to 432 units.

U.S. commercial crude inventories fell -5.836 to 415.106 million barrels, compared to a forecast of -1.2 million barrels. Gasoline inventories fell -2.075 to 227.938 million barrels. Distillate inventories fell -4.066 to 105.332 million barrels. Cushing storage fell -0.464 to 22.224 million barrels.

Oil production rose by 0.004 to 13.435 million barrels per day. Oil imports rose by 0.44 to 5.944 million barrels per day. Oil exports fell by -0.091 to 4.27 million barrels per day. Thus, net oil imports rose by 0.531 to 1.674 million barrels per day. Oil refining increased by 1.5 to 94.7 percent.

Gasoline demand rose 0.389 to 9.688 million barrels per day. Gasoline production rose 0.008 to 10.112 million barrels per day. Gasoline imports rose 0.047 to 1.007 million barrels per day. Gasoline exports fell -0.038 to 0.763 million barrels per day.

Distillate demand rose 0.048 to 3.794 million barrels. Distillate production fell -0.185 to 4.789 million barrels. Distillate imports fell -0.08 to 0.073 million barrels. Distillate exports rose 0.341 to 1.649 million barrels per day.

Demand for petroleum products increased by 0.122 to 20.513 million barrels. Production of petroleum products increased by 0.233 to 22.547 million barrels. Imports of petroleum products fell by -0.058 to 1.78 million barrels. Exports of petroleum products increased by 0.355 to 7.177 million barrels per day.

Propane demand fell -0.52 to 0.305 million barrels. Propane production fell -0.09 to 2.79 million barrels. Propane imports fell -0.012 to 0.064 million barrels. Propane exports fell -0.089 to 1.822 million barrels per day.

Let’s look at the volumes of open interest for WTI. You should take into account that this data is three days old (for Tuesday of last week), and it is also the most recent of those published by the CME Group exchange.

There are currently more open long positions of asset managers than short ones. Over the past week, the difference between long and short positions of managers has decreased by 9.1 thousand contracts. Sellers have returned to the market, there are fewer buyers. Bulls retain control.

Growth scenario: we are considering the August futures, expiration date is July 21. A breakthrough to 62.00 can be used for purchases.

Downside scenario: selling from 72.00 is quite an interesting story. Especially if OPEC+ announces that it will increase supply in August.

Recommendations for WTI crude oil:

Buy: when approaching 62.00. Stop: 60.00. Target: 72.00.

Sell: when approaching 72.00. Stop: 74.00. Target: 62.00.

Support – 63.52. Resistance – 69.23.

Gas-Oil. ICE

Growth scenario: we are considering the July futures, expiration date is July 9. When approaching 630.0, you can buy.

Downside scenario: sales will be interesting after growth to 740.0.

Gasoil Recommendations:

Buy: when approaching 630.0. Stop: 608.0. Target: 740.0.

Sell: when approaching 740.0. Stop: 770.0. Target: 630.0.

Support – 649.50. Resistance – 739.75.

Natural Gas. CME Group

Growth scenario: switched to August futures, expiration date July 29. Very emotional. We will refrain from any recommendations.

Downside scenario: don’t sell.

Natural Gas Recommendations:

Buy: no.

Sell: no.

Support – 3.402. Resistance – 3.919.

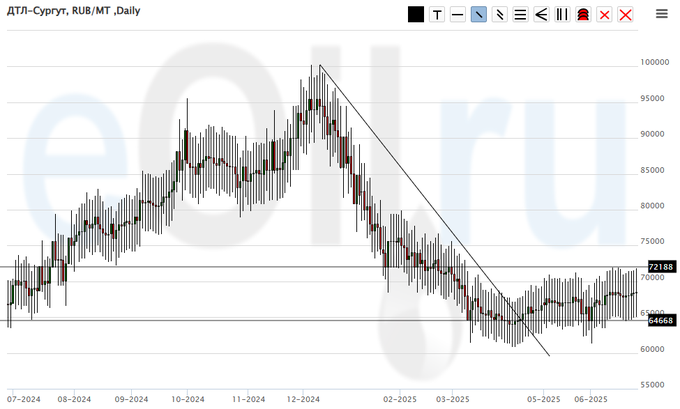

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we continue to recommend purchases. Bad things are happening to the budget. Fuel will be taxed (hypothesis).

Downside scenario: we will not sell anything. There is a constant risk of a sudden price increase.

Diesel Market Recommendations:

Buy: possible. Who is in a position from 64000, keep the stop at 60000. Target: 120000.

Sell: no.

Support – 64668. Resistance – 72188.

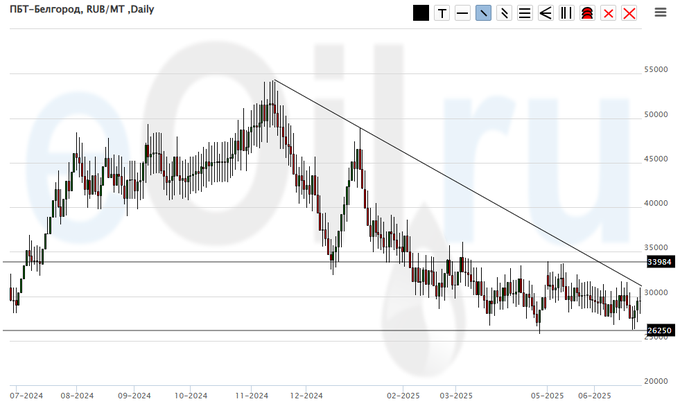

Propane butane (Belgorod), ETP eOil.ru

Growth scenario: no price surge upwards. No buying for now.

Downside scenario: we will not sell anything. There is a constant risk of a sudden price increase.

Recommendations for the PBT market:

Buy: not yet available.

Sell: no.

Support – 26250. Resistance – 33984.

Propane butane (Orenburg), ETP eOil.ru

Growth scenario: the market continues to remain in the range. We are waiting for movement, while outside the market.

Downside scenario: we will not sell. It is unlikely that we will see a fall in prices.

Recommendations for the PBT market:

Buy: not yet available.

Sell: no.

Support – 20947. Resistance – 26689.

Helium (Orenburg), ETP eOil.ru

Growth scenario: we see price movement upwards. The market reached our target at 1340 and did not roll back. A rollback is needed for re-entry. However, given the explosive nature of the market, a small volume can be bought at current prices and increased as quotes fall.

Downside scenario: still out of the market. Think from 2000.

Helium Gaseous Market Recommendations:

Buy: now (1408), add as it goes down to 1100. Stop: 940. Target: 2000.

Sell: no.

Support — 1115. Resistance — 1983.

Helium (Moscow), ETP eOil.ru

Growth scenario: sharply went up. Reached the target at 7000. For a good entry, a rollback to 6410 is needed, but given the nature of the market, you can buy small volumes at current prices and increase them as they fall.

Downside scenario: out of the market for now. Think about it after growth to 10,000.

Liquid Helium Market Recommendations:

Buy: now (7328) add as it falls to 6410. Stop: 5800. Target: 10000.

Sell: no.

Support – 6406. Resistance – 8531.

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest for Wheat. You should take into account that this data is three days old (for Tuesday of the previous week), and it is also the most recent of those published by the CME Group exchange.

At the moment, there are more open short positions of asset managers than long ones. Over the past week, the difference between long and short positions of managers has decreased by 10.4 thousand contracts. The outflow of funds from the market continues. Bears retreated faster than bulls. Bears retain control.

Growth scenario: we are looking at the September contract, expiration date is September 12. Dramatic fall due to the conclusion of a truce (peace?) between Iran and Israel. Outside the market.

Downside scenario: We are in a very oversold position. Out of the market.

Recommendations for the wheat market:

Buy: no.

Sell: no.

Support – 521.2. Resistance – 562.6.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest for Corn. You should take into account that this data is three days old (for Tuesday of last week), and it is also the most recent of those published by the CME Group exchange.

At the moment, there are more open short positions of asset managers than long ones. Over the past week, the difference between long and short positions of managers has increased by 6.3 thousand contracts. The change is significant. We see an influx of funds from sellers, no new buyers. Bears have tightened their grip again.

Growth scenario: we are considering the September contract, expiration date is September 12. Bulls have nothing to do in this market yet. We are not buying.

Downside scenario: you need to hold short. And wait. I want 300.0, but 380.0 will be a good result!!!

Recommendations for the corn market:

Buy: no.

Sell: No. Anyone in position from 440.0, move stop to 427.0. Target: 380.0.

Support – 402.4. Resistance – 418.2.

Soybeans No. 1. CME Group

Growth scenario: we are considering the September contract, expiration date is September 12. Fell down and reached balance. Out of the market.

Downside scenario: refrain from selling. The market is in balance.

Recommendations for the soybean market:

Buy: no.

Sell: no.

Support – 1005.0. Resistance – 1031.4.

Growth scenario: we are looking at the July futures, expiration date is July 29. The stop of the exchange of blows in the Middle East provoked a fall in gold. Good levels for purchases will be around 2900.

Downside scenario: the fall has begun. A good level for short is 3350.

Gold Market Recommendations:

Buy: when approaching (touching) 2900. Stop: 2770. Target: 3250.

Sell: when returning to 3350. Stop: 3370. Target: 3000 (2800).

Support – 3256. Resistance – 3349.

EUR/USD

Growth scenario: the upward momentum is, in theory, over. A pullback is needed to continue the upward move, for example to 1.0800. Otherwise, it will be difficult to push it.

Downside scenario: we need to try to sell again. The situation is technically very attractive for a short.

Recommendations for the EUR/USD pair:

Buy: no.

Sell: Now (1.1716). Stop: 1.1780. Target: 1.0800.

Support – 1.1634. Resistance – 1.1756.

USD/RUB

Growth scenario: we are looking at the September futures, expiration date is September 18. We are waiting… waiting for a jump upwards. But there is none. Not yet.

Downside scenario: it is not comfortable to sell, but we note the rise in oil prices, which may lead to an attempt to reach 75,000.

Recommendations for the dollar/ruble pair:

Buy: in case of growth above 85000. Stop: 82000. Target: 115000. Calculate risks! When approaching 75000, it is mandatory. Stop: 73300. Target: 85000 (150000?!)

Sell: no.

Support – 80075. Resistance – 83327.

RTSI. MOEX

Growth scenario: we are considering the September futures, expiration date is September 18. We can hold the purchase. But we are still inside the wedge. We do not press the stop orders too much.

Downside scenario: we need to be careful with sales for now. We need a fall below 105,000.

Recommendations for the RTS index:

Buy: No. Who is in a position from 107500, move the stop to 106400. Target: 140000?!!!

Sell: think about if it falls below 105000.

Support – 108590. Resistance – 112890.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.