Price forecast from 3 to 7 February 2025

Energy market:

European kings are in shock. Comrade T. calls and demands an island. And what about partnership? We’re here for your democracy with all the aristocratic names. And you… It looks like Berlin will spit on everything and want to reinsert the Russian pipe into itself. They don’t want Trump like that.

To the pipe! Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

So, Russia passed the 24th year quite well, one could even say decently. Oil supplies to the foreign market did not fall, and even slightly increased. Production has fallen, but it is all within the framework of the OPEC agreement. So life is not as bad as the paid economist grandfathers tell us. Yeah, the hired guns will have no money now either, there will be nothing to lurch online for. Trump took the money away. He said: “Enough!”. Good for him.

Trump’s imposition of duties has taken place. Give me the credit, Donald. We’ll give you a high grade. You’re shoving the U.S. toward inflation and ruin. Good for you. You bring the Turkish scenario to the U.S. And then… At first, resource prices will fall, but not for long. Then, because they have to choose between stimulus and inflation, they’ll choose stimulus, they’ll go up. And the one who has oil, gas, metals and heavy industry will win. So the world will become normal for a while. If the American president tries hard, this scenario will start to materialize by the end of the 25th year.

The balance in the oil market has now been reached. The 75.00 Brent level remains the line to watch out for.

Grain market:

The wheat market continues to be around 550.0, which is broadly in line with the current situation: stabilized ending stocks, the prospect of an increase in gross harvest globally, and a strong dollar. Yes, Trump may rattle the market with his desire to punch everyone in the face at the same time, but he is more likely to weaken the dollar. And then? And then that’s it, he’s in his 80s, and he’ll be like Biden, maybe a little more fun. That’s life. It doesn’t stand still.

Ah, well, where’s the grain exchange? So it still does not come out. And it is more likely that it will not, since the grain story is a strategic one. And judging by the reduction in the number of grain traders in Russia (twice in the 24th year, down to 15 companies), no one will talk about any such free trade for a long time. Trump also threatened everyone who refuses to give up the dollar with 100% duties. All the Brazilians are scared. We’re hardly scared. We’re not. But they are.

A snowless winter in the Volga region and the Southern Urals could prove fatal for Russia’s 25th year crop. Frosts are coming. The winter crops will freeze. Everything will have to be reseeded. And this is additional expenses in the spring in not the most comfortable economic situation. Nevertheless, with the help of subsidies it will be possible to do the spring complex of measures, but we should be careful to think about 70 million tons of wheat, not 75, no matter how sad it may be.

USD/RUB:

There are… no not rumors, thoughts in my head that Elvira will not raise the rate on the 14th. Perhaps this will play a positive role, provided defense spending normalizes at some level. They just have to at least stop rising. Then yes, then somehow, with one oar, it will be possible to rake off the edge of the waterfall. Otherwise, nothing but inflation growth awaits us, even if the rate is 20% or 30%.

The dollar/ruble pair itself will gravitate towards 100.00 on the horizon of one quarter. This is likely to be due to some reduction in both exports and imports. But this state of affairs will not last long. In the long run, Russia’s exports will grow, precisely at the expense of Europe. Of course, provided that their population does not show us another thuggish Fuhrer.

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers increased by 22.2 thousand contracts. Again the buyers are arriving. The growth of bullish positions has been going on for 5 weeks in a row. Very few sellers came in. Bulls continue to strengthen their control.

Growth scenario: we consider the February futures, expiration date February 28. Here comes the pullback. Thank you. We bought it. Whoever wants to, you can take it from current levels.

Downside scenario: we stay out of the market. It is possible to sell from 84.00.

Recommendations for the Brent oil market:

Buy: No. Who is in position from 75.00, move the stop to 74.99. Target: 84.00 (94.00).

Sell: on approach to 84.00. Stop: 84.80. Target: 75.00.

Support — 74.99. Resistance — 79.12.

WTI. CME Group

US fundamentals: the number of active rigs rose by 7 to 479.

US commercial oil inventories rose by 3.463 to 415.126 million barrels, with +2.2 million barrels forecast. Gasoline inventories rose by 2.957 to 248.855 million barrels. Distillate stocks fell by -4.994 to 123.951 million barrels. Cushing storage stocks rose by 0.326 to 20.981 million barrels.

Oil production fell by -0.237 to 13.24 million barrels per day. Oil imports fell by -0.297 to 6.448 million barrels per day. Oil exports fell by -0.829 to 3.686 million barrels per day. Thus, net oil imports rose by 0.532 to 2.762 million barrels per day. Oil refining fell -2.4 to 83.5 percent.

Gasoline demand rose by 0.216 to 8.302 million barrels per day. Gasoline production fell -0.044 to 9.193 million barrels per day. Gasoline imports rose 0.294 to 0.634 million barrels per day. Gasoline exports fell -0.231 to 0.762 million barrels per day.

Distillate demand increased by 0.398 to 4.506 million barrels. Distillate production rose by 0.028 to 4.738 million barrels. Distillate imports fell -0.107 to 0.182 million barrels. Distillate exports fell -0.202 to 1.127 million barrels per day.

Demand for petroleum products increased by 1.49 to 21.087 million barrels. Petroleum products production rose by 0.504 to 20.821 million barrels. Petroleum product imports fell -0.043 to 1.648 million barrels. Exports of refined products fell by -0.289 to 6.368 million barrels per day.

Propane demand rose 0.401 to 1.978 million barrels. Propane production fell -0.1 to 2.505 million barrels. Propane imports fell -0.026 to 0.175 million barrels. Propane exports rose -0.068 to 1.828 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. During the past week the difference between long and short positions of asset managers decreased by 55.9 thnd contracts. Buyers fled. Sellers appeared in small but noticeable volumes. Bulls keep control.

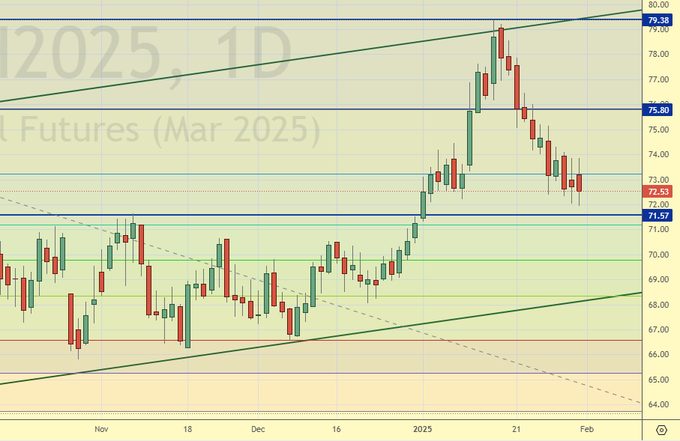

Growth scenario: we consider the March futures, expiration date February 21. Here you can buy.

Downside scenario: there is no sense to sell yet.

Recommendations for WTI crude oil:

Buy: now (72.53) and at touching 70.70. Stop: 69.20. Target: 83.00. Count the risks!

Sale: no.

Support — 71.57. Resistance — 75.80.

Gas-Oil. ICE

Growth scenario: we consider February futures, expiration date is February 10. We are waiting for a pullback to 680.0 where we will buy.

Downside scenario: most likely we will not see deep levels. Off-market.

Gasoil Recommendations:

Buy: when approaching 680.0. Stop: 670.0. Target: 900.0.

Sale: no.

Support — 688.25. Resistance — 726.75.

Natural Gas. CME Group

Growth scenario: we consider March futures, expiration date February 26. The market scares us with failures, but we don’t give in. Let’s buy again.

Downside scenario: we don’t think about sales yet.

Natural Gas Recommendations:

Buy: Now (3,044). Stop: 2,700. Target: 5,000.

Sale: no.

Support — 2.866. Resistance — 3.150.

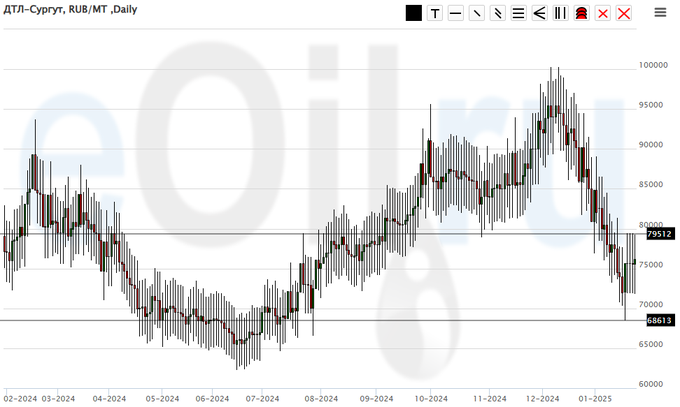

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we should buy here. Technically, the situation is favorable.

Downside scenario: we will not sell anything. There is a constant risk of a sudden rise in prices.

Diesel Market Recommendations:

Buy: No. Who is in position from 72000, keep stop at 68000. Target: 110000.

Sale: no.

Support — 68613. Resistance — 79512.

Propane butane (Surgut), ETP eOil.ru

Growth scenario: it makes sense to buy here. It is unlikely that the company will release helium cheaper. This is most likely the bottom.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: possible. Those who are in position from 900, keep stop at 770. Target: 2000.

Sale: no.

Support — 19375. Resistance is 7891.

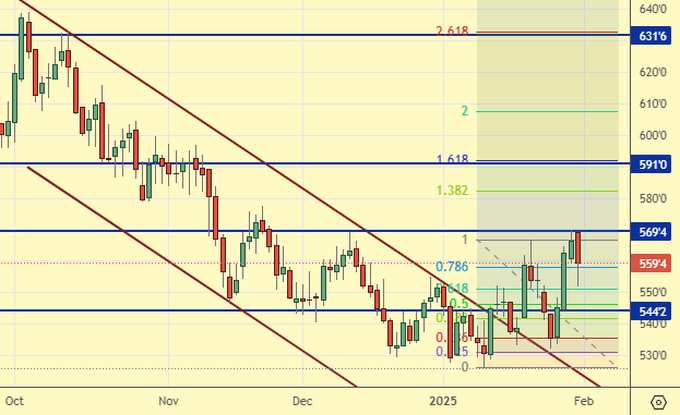

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), but it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. Over the past week, the difference between long and short positions of asset managers increased by 16.8 thousand contracts. Buyers were leaving, and sellers, on the contrary, entered the market in comparable volumes. Bears strengthened their control.

Growth scenario: we consider the March contract, expiration date is March 14. We will keep longing. We note some uncertainty of buyers.

Downside scenario: don’t sell yet.

Recommendations for the wheat market:

Buy: no. Who is in position from 533.0, move the stop to 540.0. Target: 635.0 (revised).

Sale: no.

Support — 544.2. Resistance — 569.4.

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers increased by 22.1 th. contracts. Buyers have been arriving. Sellers are not coping with the pressure and are retreating. The bulls have once again increased their control.

Growth scenario: we consider the March contract, expiration date is March 14. There is nowhere to buy. Out of the market. If we go to 440.0, then we will think about it.

Downside scenario: the current area is interesting for selling. Selling from 510.0 is also possible.

Recommendations for the corn market:

Buy: no.

Sell: on approach to 509.0. Stop: 511.0. Target: 440.0.

Support — 474.0. Resistance — 497.4.

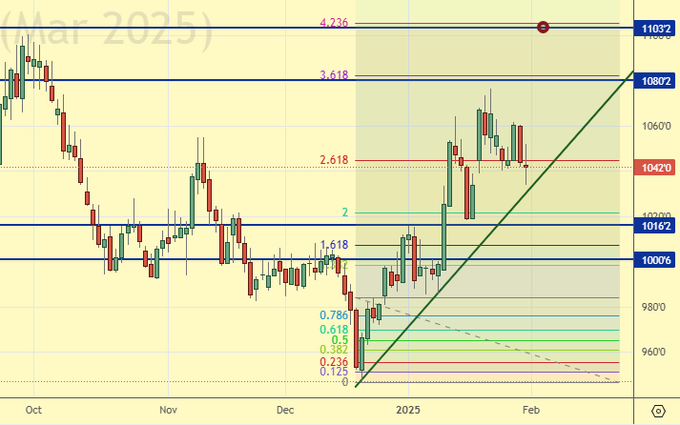

Soybeans No. 1. CME Group

Growth scenario: we consider the March futures, expiration date March 14. Nothing new. We can keep longing for now. We don’t expect high levels, but we can get to 1100.

Downside scenario: refuse to sell for now.

Recommendations for the soybean market:

Buy: no. Those who are in position from 1025.0, place a stop at 1030.0. Target: 1100.0.

Sale: not yet.

Support — 1016.2. Resistance — 1080.2.

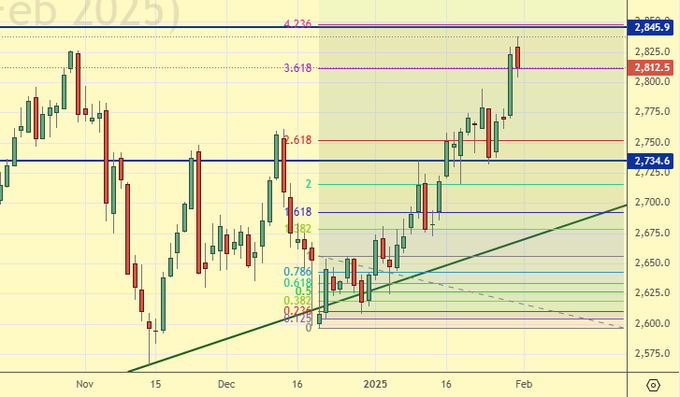

Growth scenario: we consider February futures, expiration date February 26. The bulls pulled a trick. And went straight up, setting an all-time high. You see, on the fear of duties from Comrade T., everyone, just like that, is taking bullion from London to the United States. It’s horrible.

Downside scenario: out of the market for now.

Gold Market Recommendations:

Buy: no.

Sale: no.

Support — 2734. Resistance — 2845.

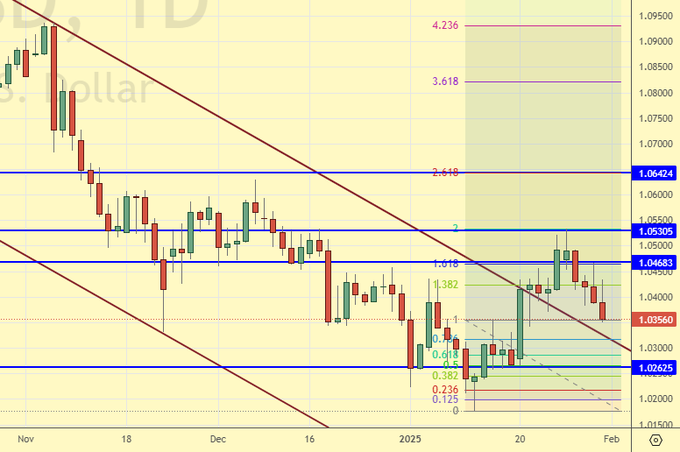

EUR/USD

Growth scenario: US rates remained unchanged in the EU declined. Classically, the pair should go down, which it is doing. A move to 0.9900 remains possible, but it is possible to buy here. The strength of the dollar with such a president will soon run out. Just don’t take that last sentence to mean “the dollar will collapse”. Please.

Downside scenario: we will refrain from selling for now.

Recommendations on euro/dollar pair:

Buy: now (1.0356). Stop: 1.0280. Target: 1.1000 (1.2000?!). From 0.9900 is mandatory.

Sale: no.

Support — 1.0262. Resistance — 1.0468.

USD/RUB

Growth scenario: we consider the March futures, expiration date March 20. Buying from the 95000 area remains attractive. Went below 101000, but there is no new low. What is it? Waiting.

Downside scenario: a possible hike to 95000 is better worked out on hourly intervals.

Recommendations on dollar/ruble pair:

Buy: when approaching 95,000.

Sale: no.

Support — 99736. Resistance — 102665.

RTSI. MOEX

Growth scenario: we consider the March futures, expiration date March 20. So far we have not been able to consolidate above the level of 96000. We want 80000 for a nice buy.

Downside scenario: the market maintains its tone. Selling from 103000 will look appropriate. Shorts from current levels are better to work out on hourly intervals.

Recommendations on the RTS index:

Buy: on a pullback to 80000. Stop: 78800. Target: 103000.

Sell: on approach to 103000. Stop: 104000. Target: 80000.

Support — 89510. Resistance — 96690.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.