Price forecast from 23 to 27 June 2025

The commander has not appointed anyone as his «beloved wife». All to hell. On Sunday morning we see that the US has gotten into a war with Iran, which may lead to the disintegration of the ancient state after some time. But not tomorrow. Tomorrow we will wait for Tehran’s response. Then they will run under bombs, then hunger, regime change, humanitarian aid. And now McDonald’s is open in the center of Tehran, and already uncovered Iranian women can finally breathe freely. This is what American happiness looks like. And it will be imposed.

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

Energy market:

After a military parade in his honor last week, Trump crossed into Iran with B-2 bombers and dozens of cruise missiles. At the cost of a couple of billions of taxpayer dollars, he announced to the world that the United States was at war. And Trump himself announced to the world that he expected peace. In fact, Iran has just been publicly flogged. Any attempt to do anything in response will be met with the prospect of a ground military operation. That is the reality.

Why did the US enter the game? Because Israel has air defense missiles for ten days. The ally needs help. The parties have pretty much shaken up their arsenals, which yesterday seemed enormous. And if it weren’t for the US, they would have calmed down in a week. Because there’s nothing to use. Now, after the Americans bombed targets of the nuclear program in Iran, few will look at Tehran with reproach if the country really closes the Strait of Hormuz. The oil market will continue to grow with the current escalation.

As previously assumed, the EU did not lower the price ceiling on Russian oil. Simply because it may happen that it will not be possible to take it in the near future on a permanent and predictable basis anywhere except Russia.

Grain market:

The current growth of wheat is constantly supported by the growing conflict in the Middle East. It is hardly possible to imagine that Iran will now say that we agree to everything, and you in Washington are right about everything. Most likely, as long as there is at least one loaf of bread in the warehouse for the local leader, the people will be obliged to “resist”. And here the problem is that as long as China buys Iranian energy resources, Israel and the USA will feel “Tehran’s special position” about who should live in this world and who should not.

It is clear that after Sunday’s bombing of nuclear facilities, panic in the government corridors of all neighboring states will increase. The problem with food is that it is heavy. We need a lot of it and it needs to be stored somewhere. Most likely, we should expect an increase in the world trade in wheat. A hungry man is a terrible man for his own leadership. So they will buy.

USD/RUB:

The escalation of the conflict between the US and Iran, which is how the current situation should be interpreted now, is unlikely to harm Russia. The ruble will most likely gravitate towards the 80.00 region, even despite the fact that the rate will probably be reduced by the Central Bank of the Russian Federation to 18% per annum on July 25. We do not rule out holding an additional meeting of the Central Bank to reduce the rate outside the main schedule. Let us recall that no one will give Russia money now, which narrows the room for maneuver. With such a rate, the entire industry will soon come to a standstill. It will have to be reduced, otherwise there will be no one to collect taxes from.

Brent. ICE

Let’s look at the volumes of open interest for Brent. You should take into account that this data is three days old (for Tuesday of last week), and it is also the most recent of those published by the ICE exchange.

There are currently more open long positions of asset managers than short ones. Over the past week, the difference between long and short positions of managers has increased by 34.2 thousand contracts. Sellers fled, bulls increased their positions. Buyers tightened their grip.

Growth scenario: we are looking at the August futures, expiration date is July 31. They flew up. Can they come back? Only if Iran surrenders, and this is unlikely now. There are no convenient levels for buying.

Fall scenario: sellers have no chance now. Outside the market.

Recommendations for the Brent crude oil market:

Purchase: no.

Sale: no.

Support – 73.02. Resistance – 78.73.

Gas-Oil. ICE

Growth scenario: we are considering the July futures, expiration date is July 9. The market has rolled back, prices have flown up. We do not open positions.

Fall scenario: don’t sell. Oil refined products may continue to rise in price.

Gasoil Recommendations:

Purchase: no.

Sale: no.

Support – 739.75. Resistance – 809.50.

Natural Gas. CME Group

Growth scenario: switched to August futures, expiration date July 29. Those in positions, hold longs. If Iran starts to sink everything that moves, this will lead to global stress for the market.

Fall scenario: don’t sell.

Natural Gas Recommendations:

Purchase: No. Who is in position from 3.847, move stop to 3.680. Target: 7.000?!

Sale: no.

Support – 3.558. Resistance – 4.196.

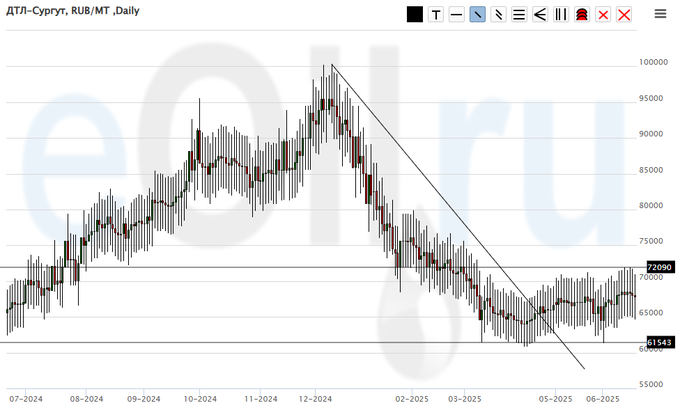

Diesel arctic fuel, ETP eOil.ru

Growth scenario: we continue to recommend purchases. Bad things are happening to the budget. Fuel will be taxed (hypothesis).

Fall scenario: we will not sell anything. There is a constant risk of a sudden price increase.

Diesel Market Recommendations:

Purchase: possible. Who is in a position from 64000, keep the stop at 60000. Target: 120000.

Sale: no.

Support – 61543. Resistance – 72090.

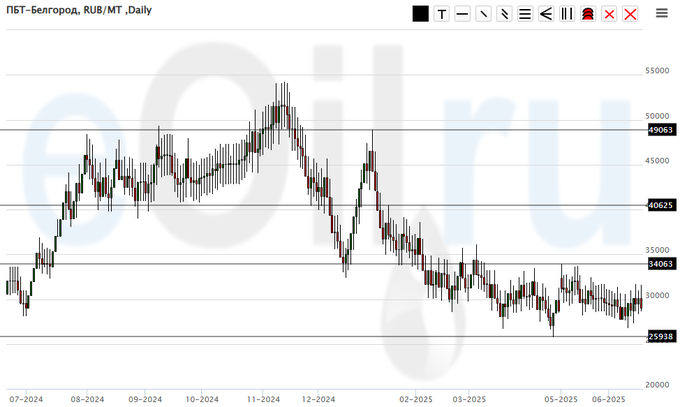

Propane butane (Belgorod), ETP eOil.ru

Growth scenario: no price surge upwards. No buying for now.

Fall scenario: we will not sell anything. There is a constant risk of a sudden price increase.

Recommendations for the PBT market:

Purchase: not yet available.

Sale: no.

Support – 25938. Resistance – 34063.

Propane butane (Orenburg), ETP eOil.ru

Growth scenario: the market continues to remain in the range. We are waiting for movement, while outside the market.

Fall scenario: we will not sell. It is unlikely that we will see a fall in prices.

Recommendations for the PBT market:

Purchase: possible. Those in a position from 64000, move the stop to 60000. Target: 120000.

Sale: no.

Support – 21084. Resistance – 26553.

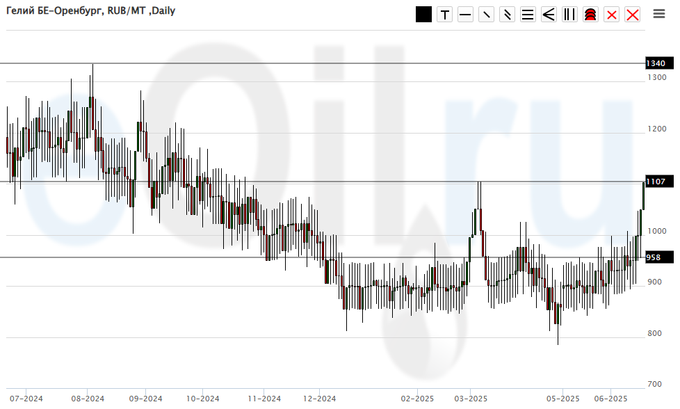

Helium (Orenburg), ETP eOil.ru

Growth scenario: we see price movement up. If you are not in a position, wait for 1110 to be taken, after which you can buy. Those who entered, hold longs.

Fall scenario: stay out of the market, prices are low.

Helium Gaseous Market Recommendations:

Purchase: possible after growth above 1110. Those in a position from 1100, move the stop to 940. Target: 1340.

Sale: no.

Support – 958. Resistance – 1340.

Helium (Moscow), ETP eOil.ru

Growth scenario: there is a hint of a reversal upwards. It can be worked out with a gradual increase in volumes according to the trend.

Fall scenario: stay out of the market, prices are low.

Liquid Helium Market Recommendations:

Purchase: Now (6021). Stop: 5200. Target: 7000 (8000).

Sale: no.

Support – 5089. Resistance – 7049.

Soybeans No. 1. CME Group

Growth scenario: switched to the September contract, expiration date is September 12. We continue to recommend buying a small volume, adding after growth above 1100.

Fall scenario: it is unlikely that we will decline against the background of active procurement of stewed meat at all factories. Feed, cattle need feed.

Recommendations for the soybean market:

Purchase: possible. Who is in position from 1046.6. Stop: 1028.0. Target: 1300.

Sale: no.

Support – 1031.0. Resistance – 1076.4.

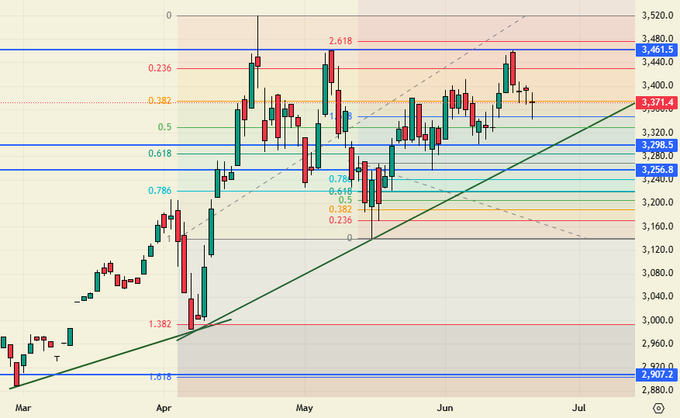

Growth scenario: switched to July futures, expiration date is July 29. Due to politics, it will be difficult to fall next week. If there is no rollback to 3000, look for opportunities to buy on «hourly» intervals.

Fall scenario: nothing has worked out for the sellers. For now. What if Iran backs down? Then we will all relax.

Gold Market Recommendations:

Purchase: no.

Sale: no.

Support – 3298. Resistance – 3461.

EUR/USD

Growth scenario: the market has set itself up for the end of Friday in such a way that we cannot yet guarantee continued growth. Outside the market.

Fall scenario: we need to try to sell again, especially if we get a gap down at the open on Monday. The US supported the dollar with bombing.

Recommendations for the EUR/USD pair:

Purchase: no.

Sell: Now (1.1521). Stop: 1.1561. Target: 1.0500.

Support – 1.1451. Resistance – 1.1543.

USD/RUB

Growth scenario: we are looking at the September futures, expiration date is September 18. We are waiting… waiting for a jump upwards.

Fall scenario: it is not comfortable to sell, but we note the rise in oil prices, which may lead to an attempt to reach 75,000.

Recommendations for the dollar/ruble pair:

Purchase: in case of growth above 85000. Stop: 82000. Target: 115000. Calculate risks!

Sale: no.

Support – 77394. Resistance – 83635.

RTSI. MOEX

Growth scenario: switched to September futures, expiration date is September 18. You can hold the purchase. However, there is not much optimism. We are still drawing a wedge.

Fall scenario: think in case of a fall below 105000. Nothing else can be suggested here. We need to see an exit from consolidation in one of the directions.

Recommendations for the RTS index:

Purchase: No. Who is in position from 107500, keep stop at 104400. Target: 140000?!!!

Sell: think about if it falls below 105000.

Support – 105230. Resistance – 110460.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.