Price forecast from 21 to 25 April 2025

It was raining in the heart of darkness. The gray devil sat on a stone under a canopy of hipbones at the entrance to the cave where the damp charcoal was stacked, flicking his tail time after time, trying to get a spark out of the flint and ignite the damp firewood. Sometimes the flame was lit, but then one of the ragged gargoyles circling nearby flew in from the darkness, flapped its wing and had to start all over again. At one point the devil had had enough of all this, and he went inside, into the rock. Without warmth, in dampness, there was only humble pining. Water continued to pour from the sky.

To sunrise and clear weather. Hello!

This release was prepared with the direct participation of analysts from trading platforms eOil.ru and IDK.ru. Here is an assessment of the situation on the global and Russian markets.

Energy market:

Oil continued to recover amid the US announcement that no duties will be imposed on Chinese electronics. This means that the rest will not be imposed either, and in general Trump should take a ballot and lie down under an IV. And since that is the case, there is no longer a threat to the world order. Comrade President got nervous… and made a lot of money with his friends on man-made panic.

Unfortunately for the US, the EU will send officials to Beijing. And they will build bridges there, as Trump has left Europe no choice. These are new introductions that are not so bad for Russia, since we are just in between. Besides, the States have forgotten where Washington is and where Berlin is. The US is in no way the center of civilization. It is clear that the 21st century, but no one has canceled the logistical shoulder yet. Modern physics denies it. It may be too late. There’s a 60% chance America is already on the back burner. Yeah, just like that, just like that.

Berlin and Paris could not have dreamed of such a gift, and they are unlikely to miss it. With its science, culture and business savvy, Europe can replace the United States from Sunday to Monday. To be modest, European cities are far more attractive than the American plains. Yeah, it’s expensive. What do you expect?

Grain market:

We claim for some upside, but bulls can’t swing the grains. Traders are not stupid, this is a specialized market after all, everyone is waiting for May WASDE report, and also watching the weather. And, oh wonder! The sun is shining, plants are growing. There are no reasons for panic.

We can assume that in the event of, let us say, a second phase of American aggravation and a new round of trade war, when obstacles are put in place to the supply of a number of components related to agriculture, we will see a drop in crop yields in a number of countries. This is not only seeds and fertilizers, but also machinery, vaccines, processing lines, and laboratory equipment.

Yes, in this case, the exhaust already by the 25th year in the fields may be lower than last year’s level. And if the dynamics continues, the 26th year will become even harder. Belarus has a new oil — potatoes, with what we congratulate our neighbors. Let’s give potato OPEC!

USD/RUB:

“We continue to believe that from 82.00 we should buy both on the exchange and in exchangers, somewhere at the end of April. Most likely, but not for sure, this will be the minimum level of the pair this year”, — we wrote earlier and got to the point that everyone who wanted to had this chance. On the spot, the ruble was heading to below 82.00. The official rate is 81.14 for Saturday.

Can we go below 80.00? Most likely they won’t let us. Talks about canceling the sale of foreign currency earnings are getting louder and louder. And we suggest you to earn together with Russian banks on the exchange rate. Buy from the area of 80.00 with a target of 120.00 by the end of the year. Why not?

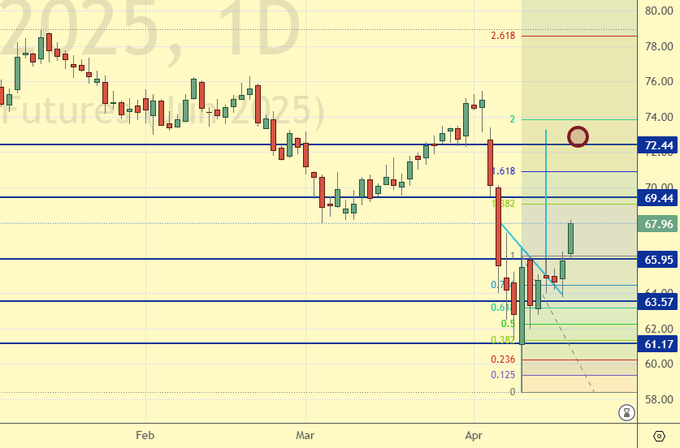

Brent. ICE

Let’s look at the open interest volumes for Brent. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by the ICE exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week, the difference between long and short positions of asset managers decreased by 161.5 thousand contracts. The change is gigantic. The bulls were simply washed away from the market. Bears have all chances to take over the initiative.

Growth scenario: we consider April futures, expiration date April 30. There is no reason and no place to buy, out of the market.

Downside scenario: continue to hold shorts, although this is not the story we originally hoped for.

Recommendations for the Brent oil market:

Buy: no.

Sell: no. Those who are in positions from 73.00 and 71.61, move your stop to 72.10. Target: 54.00.

Support — 65.95. Resistance — 69.44.

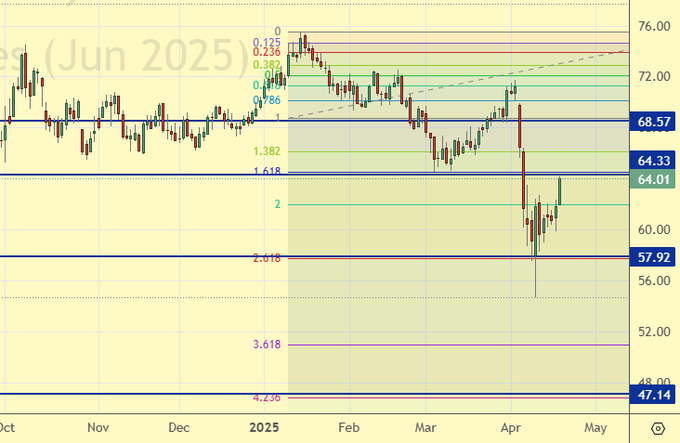

WTI. CME Group

US fundamentals: the number of active drilling rigs rose by 1 unit to 481.

U.S. commercial oil inventories rose by 0.515 to 442.86 million barrels, against a forecast of +0.4 million barrels. Gasoline inventories fell -1.958 to 234.019 million barrels. Distillate stocks fell -1.851 to 109.231 million barrels. Cushing storage stocks fell by -0.654 to 25.105 million barrels.

Oil production increased by 0.004 to 13.462 million barrels per day. Oil imports fell by -0.188 to 6.001 million barrels per day. Oil exports rose by 1.856 to 5.1 million barrels per day. Thus, net oil imports fell by -2.044 to 0.901 million barrels per day. Oil refining fell by -0.4 to 86.3 percent.

Gasoline demand increased by 0.037 mb/d to 8.462 mb/d. Gasoline production rose 0.466 to 9.412 million barrels per day. Gasoline imports fell -0.247 to 0.531 million barrels per day. Gasoline exports rose 0.06 to 0.854 million barrels per day.

Distillate demand fell by -0.148 to 3.858 million barrels. Distillate production rose 0.03 to 4.688 million barrels. Distillate imports rose 0.033 to 0.102 million barrels. Distillate exports fell -0.031 to 1.197 million barrels per day.

Demand for petroleum products fell by -0.358 to 19.123 million barrels. Petroleum products production fell by -0.174 to 20.424 million barrels. Imports of refined petroleum products fell -0.582 to 1.215 million barrels. Exports of refined products fell -0.209 to 6.889 million barrels per day.

Propane demand rose 0.148 to 1.061 million barrels. Propane production fell -0.008 to 2.744 million barrels. Propane imports fell -0.016 to 0.099 million barrels. Propane exports rose 0.227 to 1.966 million barrels per day.

Let’s look at the WTI open interest volumes. You should take into account that this is three-day old data (for Tuesday of last week), and it is also the most recent data published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers increased by 31.4 thousand contracts. Buyers actively came, sellers became somewhat less. Bulls may lose control in the nearest future.

Growth scenario: moved to June futures, expiration date May 20. Buying is not interesting yet. Out of the market.

Downside scenario: we will continue to hold the short.

Recommendations for WTI crude oil:

Buy: no.

Sell: no. Who is in the position from 69.72 (taking into account the transition to a new contract) and 68.00, move the stop to 69.80. Target: 48.00.

Support — 57.92. Resistance — 64.

Gas-Oil. ICE

Growth scenario: we consider May futures, expiration date May 9. There is nowhere to buy. Out of the market.

Downside scenario: we should keep shorting.

Gasoil Recommendations:

Buy: when approaching 420.0. Stop: 390.0. Target: 600.0.

Sell: on approach to 675.0. Stop: 680.0. Target: 420.0. Those who are in positions from 688.0 and 677.0, move the stop to 680.0. Target: 420.00 (revised).

Support — 557.75. Resistance — 641.25

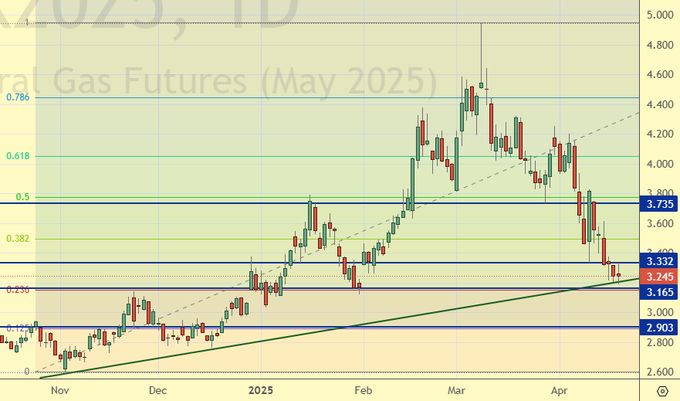

Natural Gas. CME Group

Growth scenario: we consider the May futures, expiration date April 28. Nothing has changed. We are waiting for lower levels for buying. We want 2,800.

Downside scenario: hold shorts. Crisis ahead and summer.

Natural Gas Recommendations:

Buy: when approaching 2.800. Stop: 2.600. Target: 3.600.

Sell: no. Those in position from 3.837, move your stop to 3.333. Target: 2.800.

Support — 3.165. Resistance — 3.332.

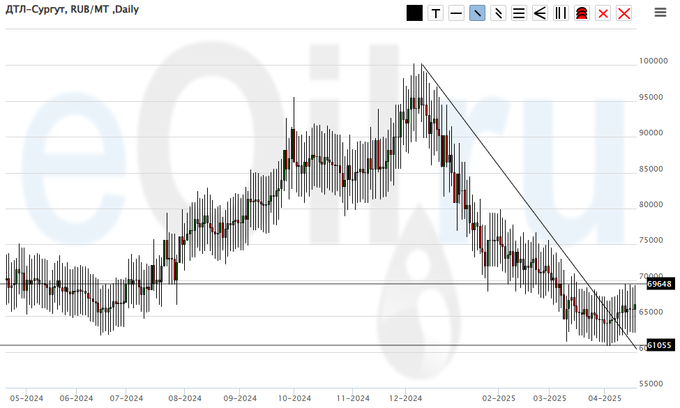

Diesel arctic fuel, ETP eOil.ru

Growth scenario: you can buy. Bad things are happening to the budget. Fuel will be taxed (hypothesis).

Downside scenario: we will not sell anything. There is a constant risk of a sudden rise in prices.

Diesel Market Recommendations:

Buy: possible. Who is in position from 64000, keep stop at 59000. Target: 120000.

Sale: no.

Support — 61055. Resistance — 69648.

Helium (Orenburg), ETP eOil.ru

Growth scenario: knocked out of longing. Now we are waiting for growth above 1100. Sad market.

Downside scenario: stay out of the market, prices are low.

Helium market recommendations:

Buy: think after rising above 1100.

Sale: no.

Support — 788. Resistance — 1028.

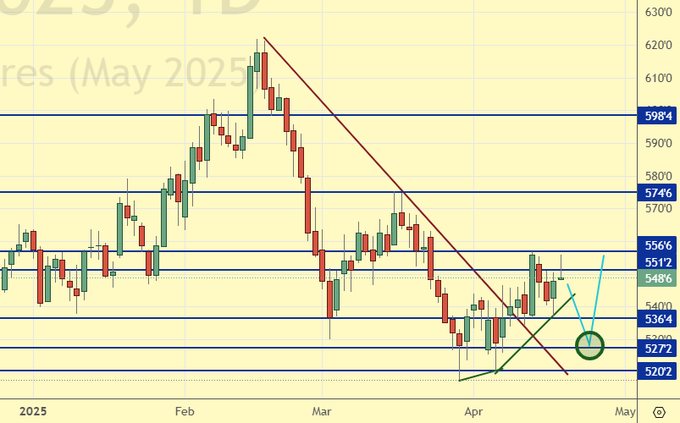

Wheat No. 2 Soft Red. CME Group

Let’s look at the volumes of open interest in Wheat. You should take into account that this is three days old data (for Tuesday of last week), and it is also the most recent data published by CME Group.

At the moment there are more open short positions of asset managers than long ones. Over the past week, the difference between long and short positions of asset managers decreased by 4.5 thousand contracts. Against the background of minimal activity, we observed a small outflow of funds from the market. Bears control the situation.

Growth scenario: we consider May contract, expiration date is May 14. If there will be a pullback, we will buy.

Downside scenario: selling is possible, but it is better to work it out on hourly intervals.

Recommendations for the wheat market:

Buy: when approaching 530.0. Stop: 520.0. Target: 700.0.

Sale: no.

Support — 536.4. Resistance — 556.6.

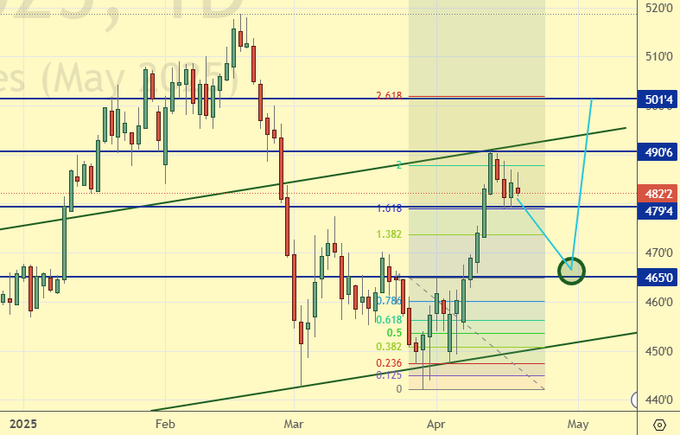

Corn No. 2 Yellow. CME Group

Let’s look at the volumes of open interest in Corn. You should take into account that this data is three days old (for Tuesday of last week), it is also the most recent of those published by the CME Group exchange.

At the moment there are more open long positions of asset managers than short ones. Over the past week the difference between long and short positions of asset managers increased by 14 thousand contracts. Sellers were running, and buyers were modestly retreating, at the expense of which the latter looked a bit better. Bulls keep control.

Growth scenario: we consider May contract, expiration date May 14. Buy only on pullbacks.

Downside scenario: an interesting situation. We are overbought.

Recommendations for the corn market:

Buy: on a pullback to 465.0. Stop: 455.0. Target: 500.0.

Sell: Now (482.2). Stop: 488.0. Target: 380.0?!

Support — 479.4. Resistance — 490.6.

Soybeans No. 1. CME Group

Growth scenario: we consider the May contract, expiration date May 14. Soybeans ran upward. A pullback to 1010.0 can be used for long entry.

Downside scenario: nothing new. The bulls blew it all away. Out of the market.

Recommendations for the soybean market:

Buy: on a pullback to 1010.0. Stop: 990.0. Target: 1200.0?

Sale: no.

Support — 1021.6. Resistance — 1049.2.

Growth scenario: we consider the June futures, expiration date June 26. The momentum upward has been worked off, which means a pullback and further growth.

Downside scenario: “shorting from 3375 is possible”, — they wrote a week earlier. Yes, it is possible to sell.

Gold Market Recommendations:

Buy: no.

Sale: now (3328). Stop: 3410. Target: 3000. Count the risks!

Support — 3265. Resistance — 3372.

EUR/USD

Growth scenario: let’s wait for a pullback to 1.1000. It is uncomfortable to buy from current levels.

Downside scenario: shorting from 1.1650 looks quite natural.

Recommendations on euro/dollar pair:

Buy: on a pullback to 1.1000. Stop: 1.0900. Target: 1.1650. Or on a pullback to 1.1150. Stop: 1.1100. Target: 1.1650.

Sell: when approaching 1.1650. Stop: 1.1720. Target: 1.0550.

Support — 1.1146. Resistance — 1.1475.

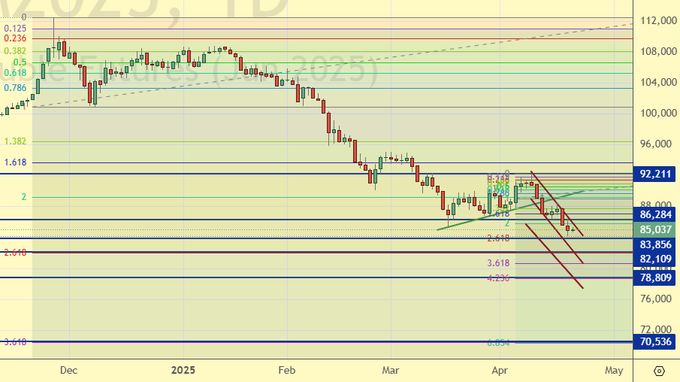

USD/RUB

Growth scenario: we consider June futures, expiration date June 19. From 82250 to buy unequivocally.

Downside scenario: the market did not give an opportunity to get a hold on the shorts. We are not selling now.

Recommendations on dollar/ruble pair:

Buy: when approaching 82250. Stop: 81400. Target: 115000?!

Sale: no.

Support — 83856. Resistance — 86284.

RTSI. MOEX

Growth scenario: we consider June futures, expiration date June 19. It flew up. Nowhere to buy. Out of the market.

Downside scenario: there will be an approach to 115000 — sell.

Recommendations on the RTS index:

Buy: when approaching 89500. Stop: 88300. Target: 110000.

Sell: on approach to 115000. Stop: 117000. Target: 80000 (60000).

Support — 101260. Resistance — 110100.

The recommendations in this article are NOT a direct guide for speculators and investors. All ideas and options for working on the markets presented in this material do NOT have 100% probability of execution in the future. The site does not take any responsibility for the results of deals.